After two years of decline, for-sale inventory in San Francisco averaged 23% below a year earlier as of May 2023. Multiple listing service (MLS) inventory has increased just slightly from the historic low reached at the end of 2021. As we make our way into the 2023 economic recession, look for home sales to fall back further.Īgents and brokers: recession-proof your life

Decreased economic expectations and still-high home prices in the region caused homebuyer enthusiasm to wane sharply in 2022. San Francisco, with its heavy concentration of high-paying tech jobs and depressingly low housing inventory, is almost an economy unto itself. Worse, as of May 2023, home sales volume in San Francisco is a whopping 36% below a year earlier and 40% below 2019 - and falling. While this annual increase is steep, the rising trend quickly fell back, with 2022 home sales volume totaling 24% below a year earlier and 9% below 2019 (the last “normal” year for housing). In 2021, annual home sales volume was a volatile 47% above a year earlier. But this decrease reversed course in 2018, with year-end totals increasing slightly, to level out in 2019. Home sales volume bumped along at a relatively level-to-down annual pace in 2012-2016, but fell significantly in 2017, a signal of the statewide downturn in sales taking place in 2018. San Francisco home sales volume peaked in 2004 - a year before the statewide peak - before receding in 2005-2006. Home sales volume in San Francisco County is volatile, but has tended to run a step ahead of the rest of the state in terms of trends. View the charts below for current activity and forecasts for San Francisco’s housing market.

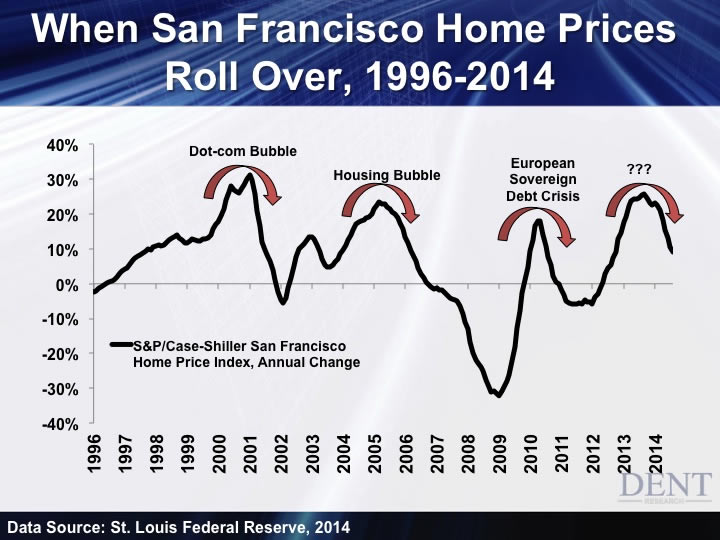

The exception will be high-tier homes, which are always the first to rise following a recession, expected to bottom in San Francisco by 2025. In the meantime, expect price declines to continue here until bottoming in 2025-2026. Absent Spring 2023’s tepid seasonal bounce, the housing market will begin a more consistent recovery in the years following the 2023-2024 recession here in San Francisco and across the state. Further, the remote work trend caused an increasing number of San Francisco residents to flee the metro area for less expensive, nearby suburbs, reducing homebuyer competition in the city. San Francisco’s infamously high home prices began to tumble in June 2022, the result of rising interest rates which immediately cut buyer purchasing power. Further, the region’s enviable jobs recovery from the 2008 recession did not shield San Francisco residents from the impacts of the 2020 recession, with job losses just regained at the end of 2022. Here, jobs and home values were recovered quickly following the 2008 recession due to the presence of the high-paying tech industry.Īll the same, the high competition stemming from high prices and limited inventory have shut out many residents, causing a housing crisis for renters and homebuyers alike. San Francisco is a unique region in California’s housing landscape.

0 kommentar(er)

0 kommentar(er)